Many buyers are drawn to Fort Lauderdale condos for the lifestyle, views, and lower maintenance compared to single-family homes.

But one question matters more than most buyers realize: What financial risks should you check before buying a condo in Fort Lauderdale? Missing the answer can lead to higher costs, loan issues, or resale problems.

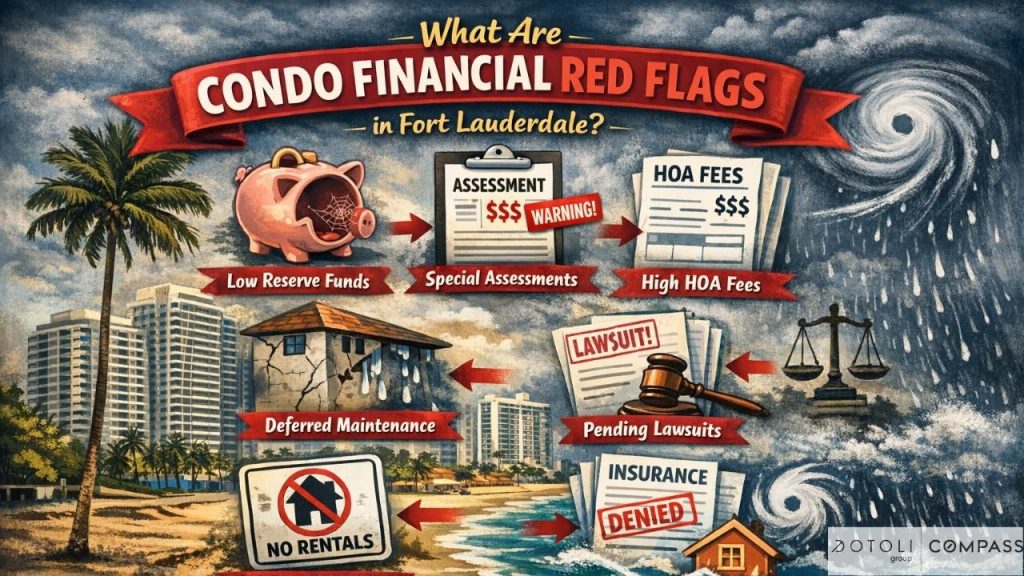

What are Condo Financial Red Flags

Quick Answer

The biggest condo risks in Fort Lauderdale come from HOA finances, special assessments, insurance gaps, and building condition, not just the unit price.

A condo can look like a good deal on paper, but become expensive if the building’s finances are weak.

Why Condo Due Diligence Matters More in 2026

Florida condo regulations and insurance realities have made financial transparency more important than ever.

Today, lenders, insurers, and buyers all examine:

- Building reserves

- Maintenance history

- Insurance coverage

- Structural condition

Condos with weak financials often:

- Cost more in the long term

- Take longer to sell

- Face financing restrictions

7 Financial Red Flags Condo Buyers Should Never Ignore

1. Low Reserve Funds

What it means:

The HOA has little savings for future repairs.

The HOA has little savings for future repairs.

Why it matters:

Low reserves increase the chance of special assessments for:

Low reserves increase the chance of special assessments for:

- Roof replacements

- Concrete restoration

- Structural repairs

- Elevator upgrades

Healthy buildings maintain strong reserves to avoid sudden costs.

2. Frequent Special Assessments

What it means:

Owners are repeatedly asked to pay extra fees.

Owners are repeatedly asked to pay extra fees.

Why it matters:

This signals:

This signals:

- Poor budgeting

- Deferred maintenance

- Financial instability

One assessment may be manageable. Repeated ones are a pattern.

3. High Delinquency Rates

What it means:

Many owners are behind on HOA payments.

Many owners are behind on HOA payments.

Why it matters:

High delinquency can:

High delinquency can:

- Strain building finances

- Affect maintenance quality

- Make lenders cautious

Some lenders decline loans in buildings with high delinquency.

4. Inadequate Insurance Coverage

What it means:

The association lacks sufficient property or liability insurance.

The association lacks sufficient property or liability insurance.

Why it matters:

Insurance gaps can:

Insurance gaps can:

- Increase owner risk

- Lead to sudden cost-sharing

- Affect financing approval

Insurance quality now plays a major role in condo valuations.

5. Deferred Maintenance

What it means:

Visible issues are not being addressed.

Visible issues are not being addressed.

Examples include:

- Concrete cracks

- Worn roofs

- Plumbing concerns

- Aging balconies

Why it matters:

Deferred maintenance usually leads to larger future bills.

Deferred maintenance usually leads to larger future bills.

6. Ongoing or Past Litigation

What it means:

The association is involved in legal disputes.

The association is involved in legal disputes.

Why it matters:

Litigation can:

Litigation can:

- Delay financing

- Increase insurance costs

- Create uncertainty for resale

Not all litigation is harmful, but it must be understood.

7. Unrealistically Low HOA Fees

What it means:

Fees seem too good to be true.

Fees seem too good to be true.

Why it matters:

Low fees may indicate:

Low fees may indicate:

- Underfunded reserves

- Delayed maintenance

- Future fee increases

Low fees today can mean high costs tomorrow.

A Micro-Local Reality Buyers Should Know

In Fort Lauderdale, two condos at the same price with the same view can have very different long-term costs depending on the building’s financial health.

The building matters as much as the unit.

What Smart Condo Buyers Do Differently

Experienced buyers review:

- Reserve studies

- HOA budgets

- Insurance certificates

- Meeting minutes

- Assessment history

This reveals the true cost of ownership beyond the listing price.

Frequently Asked Questions

Are Fort Lauderdale condos a good investment in 2026?

Yes, when the building is financially sound and well-maintained. Location and HOA health strongly influence value and resale.

Can HOA problems affect my mortgage approval?

Yes. Lenders review building finances. Weak reserves or litigation can delay or block loans.

Are special assessments always bad?

Not always. Planned assessments for improvements can be positive. Surprises or repeated ones are the concern.

How many months of reserves should a condo have?

Many lenders prefer associations with adequate reserves relative to maintenance obligations. Exact expectations vary by building and loan type.

Should buyers review HOA documents before making an offer?

Yes. Reviewing financials early prevents surprises and improves clarity in negotiations.

Clear Next Step

Buying a condo in Fort Lauderdale is not just about choosing a unit. It is about choosing a financially stable building.

If you are planning to buy or sell a luxury condo or home in Fort Lauderdale, informed decisions start with the right guidance.

DOTOLI Group works with luxury buyers and sellers who want clarity on building finances, ownership costs, and long-term value, not just listings.

When you are ready to move forward, start with a strategy built on transparency and local expertise.